Small Team Approach | Minimize Complaints | Amazing Results

Extend the Capabilities of Your Business Office

A/R Out of Control?

There is a better way!

If debt collection efforts are taking up too much of your valuable time and putting a strain on your business, we are here to help. We specialize in resolving delinquencies and will work with you to develop personalized solutions that are right for your company.

a lot of paper

Amazing A/R Solutions

Complete A/R Cycle Solutions Available

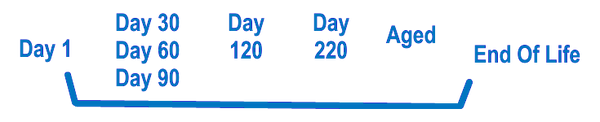

As an effective extension to your business office, we offer our experienced staff, compliant contact center, and advanced technologies to efficiently manage your accounts receivable inventory from day one through the end of the debt collection life cycle. Our highly trained staff work with your customers and help them resolve financial challenges while preserving your relationships.

Precollections & Early Outs

We offer our Precollection services for accounts not yet ready for full collection measures. Reaching patients close to their service date and discussing payment options is often all it takes to softly nudge your early delinquencies into good standing.

... Read More

Supercharge Your Collection Department

We offer our full service collection department to supercharge your debt collection efforts. Our highly trained staff work with your customers and help them resolve financial challenges while preserving your relationships.

Secondary & Tertiary Collections

We offer our full service collection department to revive your aging accounts. Our proprietary systems are able to target and concentrate on those accounts that have a propensity to pay.

Professional Attorney Referral

We have the tools and solutions to turn non-performing accounts into revenue. For those electing legal remedies, we offer referrals to our internal network of local professional law firms.

Specific Workflows

Specific Workflows

Specific Workflows

We offer specific workflows designed to adhere your compliance requirements, including non-profit 501(r) compliance and state requirements, including Minnesota Attorney General Agreement.

Special Projects

Specific Workflows

Specific Workflows

Changing billing systems? Change of ownership? We offer your operations a bridge support system, personalized solutions and, staffing to assist during times of transitions.

A/R Financing

Specific Workflows

A/R Financing

Accelerate cash flow with A/R financing options. Contact our sales staff to discuss options unique to your operation.

Our Proven Approach

Small Team Units

Our small team unit strategy ensures our highly trained representatives become intimately familiar with your business while developing tactics in a team environment to specifically service your customers. Our personalized approach enables us to handle large volumes while remaining flexible to your needs.

Great Customer Service

You and your staff will have dedicated support. Every client has a committed sales representative that can help navigate best personalized solutions for your operations and make the implementation process seamless. Your staff will have portal access to real-time account information and reports 24/7 as well as a dedicated collection manager to assist with daily inquiries.

Demonstrated Proprietary Processes

Our methods are proven through our results. We sustain above average debt recovery rates while maintaining a remarkably low complaint rate. Our representatives' trained negotiating skills, and closely monitored conversations together with advanced automation, proprietary scoring, inescapable skiptracing, broad linguistic abilities, and contact technology allow us to implement processes that are extremely effective.

Our Exceptional Capabilities

Incredibly Advanced Automation

Our heavy investment in advanced technology and business office automation, balanced with human intervention, delivers bottom-line results for your organization. We've gone beyond streamlining calls and letters to develop a unique set of skills automating many other business office operations, thus increasing the quality and effectiveness of our debt recovery.

Enterprise Software

Advanced Integration

Enterprise Software

Our systems have advanced capabilities with real-time client and consumer portals, account & payment tracking, and advanced reporting capabilities.

Contact Technology

Advanced Integration

Enterprise Software

We use a human intervention manual-dial-only system, call recording, and speech analytics to maximize contact center compliance.

Advanced Integration

Advanced Integration

Advanced Integration

We have the ability to generate or receive just about any file type, including EDI, perform inventory audits, and interface directly with your systems.

Propensity to Pay Scoring

Propensity to Pay Scoring

Propensity to Pay Scoring

We've developed a unique proprietary capability to score an account's propensity to pay or financial assistance eligibility using non-credit sources.

Skip Tracing

Propensity to Pay Scoring

Propensity to Pay Scoring

We've instituted a waterfall process using internal and external database sources to locate wrong addresses and phone numbers and monitor credit activity.

Credit Bureau Reporting

Propensity to Pay Scoring

Credit Bureau Reporting

Our systems have credit bureau reporting and automated eOscar capabilities to manage disputes from consumers or credit repair shops.

Compliance Scrubbing

Compliance Scrubbing

Compliance Scrubbing

We screen and monitor accounts for bankruptcy, deceased, fraud, military, minors, duplicates, red flags, demographics integrity, and more

Advanced Reporting

Compliance Scrubbing

Compliance Scrubbing

Our enterprise system allows users to generate real-time reports upon demand. Custom reporting and delivery options are available upon request.

Linguistics

Compliance Scrubbing

Linguistics

We speak the language of your consumers in the community in which you serve.

Personalized solutions to Ensure Top-Notch Debt Recovery Rates

Compliance

Compliance

Compliance

We adapt everyday to the ever changing compliance landscape environment.

Security

Compliance

Compliance

We've designed redundant administrative, technical, and physical systems and safeguards to protect data.

Training

Compliance

Training

Our agents are highly trained, as we institute a required rigorous training program upon hiring, along with annual assessments with continuing education.

Services & Features

Biggest Bang For Your Buck!

Competitive Pricing Tailored To Your Individual Full-Featured Solution

From fixed-fee to contingency, we have just the right pricing to fit your tailored solution

Come Meet Our Sales Professionals

Contact Sales

Let Us Be Part Of Your Team

Creditor Advocates

4719 Park Nicollet Ave SE #115, Prior Lake, Minnesota 55372, United States

Disclosures

By continuing to use this site, you accept our Terms of Service, Privacy Policy, and our use of cookies.